Sushma Ramachandran

Sushma Ramachandran

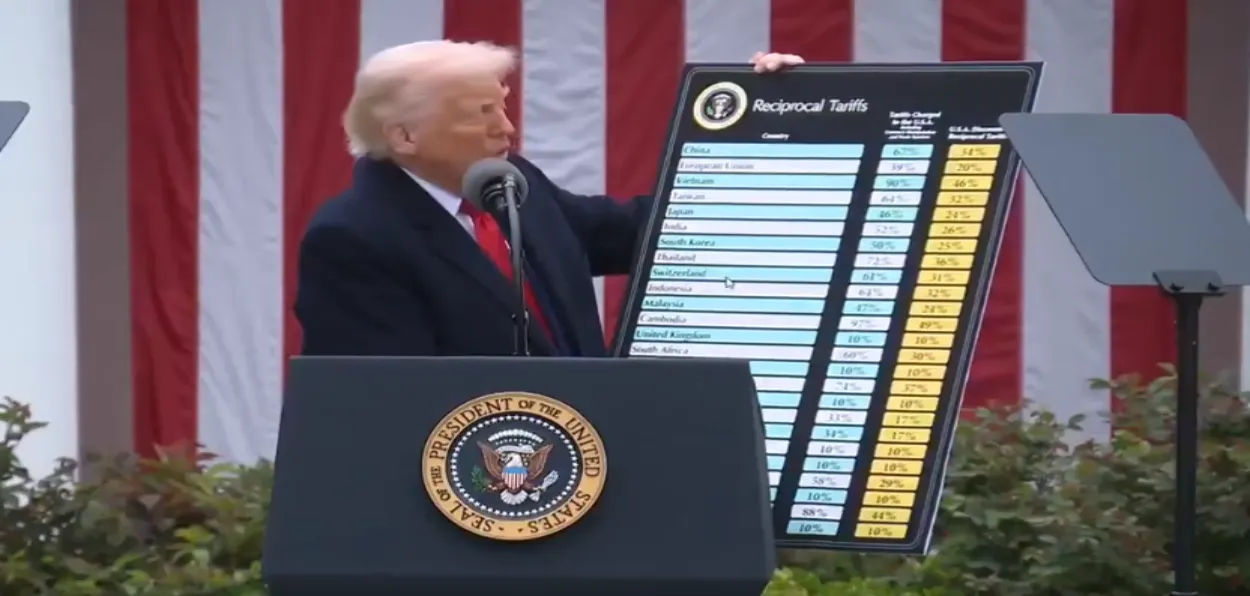

The uncertainty is finally over. Donald Trump’s threat of raising tariffs on nearly all U.S. trading partners has finally come true. In the process, the world’s biggest economy has managed to antagonise not just its enemies but its closest allies. It has also raised the specter of recession that could quickly become a contagion in the global arena.

Besides, the unilateral imposition of tariffs is not just an isolated event; it threatens to upset an international trading system that had been meticulously set up after the Second World War. The entire process of creating the Generalised Agreement on Tariffs and Trade (GATT), which ultimately led to the formation of the World Trade Organisation (WTO), seems to have been reversed in one fell swoop.

In the midst of this global turmoil, the impact on India is bound to be of immediate concern but equally, there is worry over the future of the rules-based multilateral trading system that had been hammered through many decades of negotiations.

It also must be recognized that the creation of the WTO ensured that the South had a significant voice in the multilateral arena. India, for instance, played a big role in formulating the rules and procedures of the organisation despite the enormous clout wielded by the developed world. The breakdown of the system by the Trump administration is indicative of the fact that the U.S. has not been able to have its way on all issues in this body.

The question now is, whether the WTO will become irrelevant in this new scenario of bilateral trade pacts with the US leading the way. China has hit back with retaliatory tariffs so the trade war is well and truly underway. The outlook for world trade is thus looking bleak. The WTO has already forecasted that world trade in goods could contract by one percent due to the tariff wars. “While the situation is rapidly evolving, our initial estimates suggest that these reciprocal tariffs, coupled with those introduced since the beginning of the year, can lead to an overall contraction of around one percent in global merchandise trade volumes this year, representing a downward revision of nearly four percentage points from previous projections,” WTO director general Ngozi Okonjo-Iweala said in a statement.

Simultaneously, Wall Street firms are predicting a 40 to 60 percent chance of a recession in the U.S. Goldman Sachs had earlier forecast that the probability has gone up from 20 to 35 percent. Now J.P. Morgan has raised the risk of recession to 60 percent from 40 percent earlier, citing “disruptive American politics” as being the biggest risk to global outlook.

The effect of this tax hike, it said, is likely to be magnified through retaliation, a slide in US business sentiment, and supply chain disruptions. The firm calculated the new tariffs would cost US consumers about 700 billion dollars. These predictions, however, were made before China retaliated with a 34 percent tariff hike on American goods.

Inflationary pressures will mount soon in the U.S. with prices of imported goods shooting up as a result of the new tariffs. In addition, Trump’s vision of reviving the U.S. as a manufacturing nation will not happen anytime soon. Though the tariff policies have been launched ostensibly to bring industry back to American shores, the reality is that this will not take place in most sectors. In others, projects may be mooted but actual implementation will take a long time.

Against this backdrop, the impact of the tariff bombshell on the Indian economy may not be as dire as for many other countries. But it could end up being a drag on growth. There is little unanimity on the issue but some economists expect the higher tariffs to slow growth by 20 to 30 basis points. Goldman Sachs has revised its growth estimate for 2025-26 from 6.3 to 6.1 percent while Citibank expects a dip of 40 basis points. In sharp contrast, domestic securities firm Ventura maintains that India’s relatively mild tariffs compared to other countries put it in a strategic position to benefit from a shift of global manufacturing from China.

It argues this trend will only accelerate, presenting India with an opportunity to emerge as a key manufacturing hub. The firm even points out that possible global interest rate cuts could stimulate consumption and provide a further tailwind to the economy.

Trade experts are equally divided on the effect on exports to the US. Some areas like gems and jewellery along with electronics, engineering goods, and marine products are likely to face a hit. There could be opportunities, however, in other sectors like textiles and apparel given the fact that competing countries are facing higher tariffs than India.

All these concerns will now have to be raised during the ongoing negotiations for a bilateral trade pact. India is one of the few countries that began these discussions before the tariff hikes so there is expected to be some room for compromise on both sides. The areas of sensitivity for this country are the dairy and agriculture sector where hundreds of subsistence-level farmers need protection. While the US complains about the lack of market access in this sector, it glosses over the enormous subsidies given to its farmers. These are issues that will have to be raised during the bilateral treaty talks and there is bound to be room for compromise.

ALSO READ: IMEC got a revival with Modi's visits to France and USA

Yet it is clear the world of international trade has been disrupted and may not become the same again for a long time. Looking from the lens of a pessimist, there is an advantage for us as India is seen as a safe haven investment destination compared to neighbouring China. Yet to take advantage of this situation, we need to remove the regulatory cholesterol in the system so that doing business becomes easier here compared to other Asian economies like Indonesia and Vietnam. The crisis needs to be turned into an opportunity, but this requires deeper reforms to bring about deregulation and the opening up of the economy.

The author is a veteran journalist who writes on economy and global issues.